I’ll never forget the day I got that dreaded notice on my door. My stomach dropped, my palms went sweaty, and suddenly, every plan I had for the next year felt like it had been set on fire.

If you’ve ever been through an eviction, you know the feeling — shame, panic, and about a thousand questions swirling in your head. The one that haunted me the most was, “How long does an eviction stay on your record?”

It’s a fair question because that single event can follow you around long after you’ve packed up and moved out. I had to learn the hard way that while some parts of an eviction fade with time, others stick like glue.

But here’s the good news: understanding how it works — and what you can do about it — puts the power back in your hands.

What Actually Stays on Your Record After an Eviction?

When I first started trying to rent again, I assumed the eviction itself was haunting my credit score. I was wrong. The reality is a little more complicated — and a lot more manageable once you know the details.

There are two separate records to think about: your public record and your credit report. They’re not the same thing, and landlords may check either (or both) when you apply for a new place.

On your public record, the eviction lawsuit itself becomes a permanent entry. It doesn’t fall off after a few years or magically disappear.

Court filings are public documents, and anyone — including potential landlords — can access them, often with just a quick search online. That means even an eviction from 10 years ago can technically still show up.

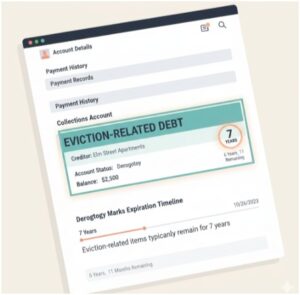

On your credit report, though, things work differently. The eviction itself won’t appear, but any related debt — like unpaid rent that went to collections or a civil judgment — will.

That’s the part that usually stings your credit score. The silver lining? That negative mark typically drops off your credit report after seven years, just like most other debts.

How Long Does an Eviction Stay on Your Record With Landlords Checking?

Here’s where things get interesting. Even if your credit report is clean after seven years, the eviction lawsuit in your public record doesn’t have an expiration date. But whether it affects you depends on who’s looking and how they interpret it.

Big property management companies often have strict “no eviction” policies. They don’t care if it happened last year or last decade — they’ll deny your application outright.

I ran into this a few times, and it was frustrating to know that a mistake from my past could still cost me a new home.

Smaller, independent landlords, however, tend to be more flexible. Many don’t even use automated tenant screening services and instead review applications personally.

If you can explain your situation honestly and show that your circumstances have changed, they’re far more likely to give you a second chance. That human element matters more than most people realize.

Does Paying Off the Debt Help Remove the Eviction?

One of the smartest things I did was address the unpaid rent tied to my eviction. It didn’t erase the public record, but it did help me rebuild trust with future landlords — and improve my credit.

If your eviction involved unpaid rent and that debt ended up as a judgment or collections account, paying it off can make a difference.

Once it’s marked “paid in full,” it looks a lot better to anyone reviewing your history. Some landlords may even be willing to help you get the judgment removed if you settle what you owe.

And here’s a bonus tip: after you pay off any outstanding debt, pull your credit report from one of the major agencies (Experian, Equifax, or TransUnion) to make sure it’s updated correctly. Sometimes errors slip through, and catching them early can save you headaches later.

How to Rent Again After an Eviction on Your Record

So, you’ve got an eviction in your past — now what? I’ve been there, and I promise it’s not the end of your renting life. With the right strategy, you can still land a great place.

Here’s what worked for me and for many others I’ve spoken to:

Be Honest and Tell Your Story

If a landlord asks about the eviction, don’t dodge it. I learned that trying to hide it only raised more red flags. Instead, I prepared a short, honest explanation: what happened, why it happened, and what’s changed since then. Most landlords appreciate honesty, and many are more forgiving when they understand the context.

Look for Private Landlords

Large apartment complexes often have rigid policies, but small “mom-and-pop” landlords make decisions on a case-by-case basis. They’re more likely to listen to your story and give you a chance if they see you’re stable and responsible now.

Offer Extra Security

Want to stand out as a trustworthy tenant? Offer a larger security deposit or pay a few months’ rent upfront. That gesture shows you’re serious and financially stable, which can outweigh concerns about your past.

Quick Comparison: Eviction on Public Record vs. Credit Report

| Feature | Public Record | Credit Report |

| What Appears | Eviction lawsuit filing | Civil judgment or collections account for unpaid rent |

| Duration | Permanent (does not expire) | Typically removed after 7 years |

| Who Checks | Landlords, tenant screening services | Landlords, lenders, credit agencies |

| Can It Be Removed? | No, but you can explain circumstances | Yes, after 7 years or if paid and disputed |

| Impact on Renting | Varies by landlord’s policy | Affects credit score and financial trustworthiness |

How Can You Check If the Eviction Is Still Showing?

Before you start apartment hunting again, do a little digging. I wish I had done this earlier — it would have saved me a lot of rejection and confusion.

First, search your name on your county or city court website to see if the eviction filing is still visible. Most jurisdictions have online databases now. If it’s there, it’s staying there — but you’ll know what potential landlords might see.

Next, request a copy of your credit report. Federal law lets you get one free report from each of the three major credit bureaus every year at AnnualCreditReport.com. Check for any unpaid rent accounts or judgments related to the eviction and see if they’ve aged off your report.

FAQs About How Long Does an Eviction Stay on Your Record

Does an eviction automatically fall off after seven years?

Not exactly. The debt from an eviction usually falls off your credit report after seven years, but the eviction lawsuit itself remains on public record indefinitely. That means landlords can still see it, even decades later, if they look in the right place.

Can you remove an eviction from your record?

You generally can’t erase a court filing from your public record. However, if you pay off any associated debt, you can sometimes work with the landlord to request that a judgment be removed. Even if it stays, resolving the debt improves your credibility with future landlords.

Will an eviction prevent me from renting again?

It depends on the landlord. Corporate property managers may deny your application, but many independent landlords are open to applicants with past evictions if they demonstrate financial stability and explain their situation honestly.

Does bankruptcy clear eviction records?

Filing for bankruptcy might discharge unpaid rent debt, but it doesn’t erase the eviction lawsuit from your public record. Landlords can still see that an eviction occurred, even if the financial part is resolved.

A Fresh Start Is Still Possible

I know firsthand how heavy an eviction can feel. It’s embarrassing, it’s stressful, and it can make you doubt your future. But it doesn’t define you — and it doesn’t mean you’ll never rent again.

The truth about how long does an eviction stay on your record is this: while the public record doesn’t disappear, the impact it has on your life can fade with time, responsibility, and transparency. Deal with any debt, own your story, and approach the rental process with honesty and confidence.

Your past might show up in a database, but it doesn’t have to hold you back from building a stable, comfortable home again. Trust me — I’ve been there, and you absolutely can bounce back.