I’ll never forget the first time I tried to buy a house. I had saved for years, spent countless weekends touring open houses, and finally found a charming little fixer-upper that felt perfect.

Then came the curveball: during the final steps, my real estate agent mentioned there might be an old contractor’s lien on the place. I froze. I had no idea what that meant or how to deal with it.

That’s when I learned that knowing how to find a lien on a property isn’t just for lawyers — it’s something every buyer, seller, and even curious homeowner should understand.

If you’ve ever wondered how to uncover hidden debts or legal claims tied to a house, stick with me. I’ll share what I learned the hard way — from free DIY methods to expert-backed solutions — and make sure you never get blindsided like I did.

What Exactly Is a Lien and Why Should You Care?

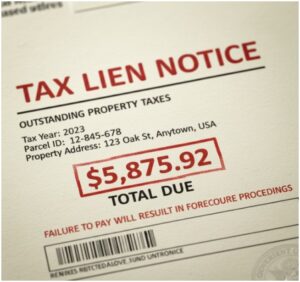

Before we talk about how to find a lien on a property, it’s worth understanding what a lien actually is. A lien is a legal claim against a property, usually because the owner owes someone money. It could come from unpaid property taxes, a contractor bill that was never settled, or even a court judgment.

The scary part? Liens stay with the property — not the person. So if you buy a house with an existing lien and don’t know about it, you could end up responsible for someone else’s debt. And trust me, that’s not a surprise you want after signing the biggest check of your life.

The good news is that liens are public record. That means you can find them — and with a bit of know-how, you can do it without hiring a lawyer.

Where Do You Start When Looking for Liens?

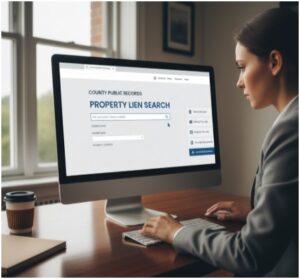

When I first tried to figure out how to find a lien on a property, the process felt overwhelming. But once I broke it down, it was much simpler than I expected. The best starting point? Your local county offices.

The county recorder’s office (sometimes called the register of deeds or county clerk) is your go-to. This office keeps records of deeds, mortgages, and most liens filed against properties in that area.

Many counties even have online search tools where you can look up liens using the property address or the owner’s legal name.

If online searches aren’t an option, you can visit the office in person. Staff can often help you search the records, and while viewing the documents might be free, you’ll likely pay a small fee if you want printed copies.

This step alone can reveal tax liens, contractor liens, and even some court-related claims. It’s a goldmine of information — and it’s available to anyone willing to do a little digging.

How Can You Search for Liens on Your Own?

I’ll be honest: the DIY route isn’t glamorous, but it’s empowering. Once you know how to find a lien on a property yourself, you’ll feel much more confident in any real estate deal.

Here’s how I do it step-by-step:

- Gather the basics. You’ll need the property’s address and the full legal name of the current owner.

- Start at the county recorder’s website. Many counties let you search public records for free or for a small fee. Look for anything labeled as a lien, claim, or encumbrance.

- Check the tax assessor’s office. This is where property tax records live. If taxes are unpaid, there may be a tax lien in place.

- Review court records. If the owner has any unpaid judgments against them, a creditor might have filed a judgment lien with the local courthouse.

- Check state and federal tax portals. Federal tax liens from the IRS are usually recorded locally, and many states have online portals where you can look up state tax liens.

The best part? Most of these searches are free or cost just a few dollars. If you’re willing to invest some time, you can uncover a lot without spending much money.

Should You Hire a Title Company Instead?

When I bought my second home, I decided not to go the DIY route. Instead, I hired a professional title company. If you’re serious about buying or selling, this is often the safest and most comprehensive option.

A title company specializes in uncovering every possible claim against a property. They don’t just check public databases — they dive deep into decades of records, ensuring nothing slips through the cracks. This is especially helpful for older homes, which may have a long and complicated ownership history.

There’s another bonus: title insurance. When you buy a home, the title company can issue insurance that protects you (and your lender) against financial losses if a hidden lien shows up later. It’s peace of mind that’s worth every penny.

Here’s a quick comparison of DIY vs. professional searches:

| Method | Cost | Thoroughness | Best For |

| DIY search | Free – $20 | Moderate | Quick checks, curious homeowners |

| Title company | $150 – $400 | Very high | Buyers, sellers, and real estate transactions |

Why Is It So Important to Check for Liens?

If you’re still wondering why all this matters, let me put it this way: skipping this step can cost you thousands. I once knew a buyer who skipped a proper lien search to “save time.”

Weeks after closing, they received a letter about an unpaid contractor bill from three years earlier. It became their responsibility — even though they never hired that contractor.

When you understand how to find a lien on a property, you protect yourself from situations like that. It ensures:

- Clear ownership: You know the seller legally owns the property.

- No surprise debts: You won’t inherit someone else’s unpaid bills.

- Financial security: Lenders feel more confident, which helps your loan process.

It’s a small effort now that can save you massive headaches later.

How Do You Handle a Lien If You Find One?

Finding a lien doesn’t always mean you should run away from the property. In many cases, liens can be resolved before closing.

The seller might pay off the debt, negotiate with the creditor, or even challenge the lien in court if it’s invalid.

If you’re buying, make sure any lien is cleared before you close. Your real estate agent or title company can guide you through the process and ensure the property title is free and clear before your name goes on the deed.

FAQs About How to Find a Lien on a Property

Q1: Can I check for liens online for free?

Yes, many counties have free online search tools where you can look up liens by property address or owner name. If online access isn’t available, you can visit the recorder’s office in person.

Q2: Do liens show up on property listings?

Usually, they don’t. Property listings focus on selling points, not legal issues. That’s why it’s important to do your own search before buying.

Q3: How long does a lien stay on a property?

A lien typically stays until the debt is paid or the claim expires under state law. Some liens can last for years if they aren’t addressed.

Q4: Should I still buy a property with a lien?

It depends. If the lien will be cleared before closing, it’s usually fine. But if the seller refuses to resolve it, consider walking away or consulting a real estate attorney.

Wrap It Up: Don’t Let Liens Sneak Up on You

Learning how to find a lien on a property turned me from a nervous first-time buyer into someone who walks into real estate deals with confidence. Whether you choose the DIY route or bring in the pros, the key is not to skip this step.

Think of it as part of your due diligence — like checking under the hood before buying a car. It might not be the most exciting part of the process, but it’s one of the smartest.

And once you’ve done it, you’ll know that the home you’re buying is truly yours — without anyone else’s debt attached. Your dream home deserves a clear title. Make sure you give it one.